Following the discussion from the last issue about creating payment plans for customers impacted by COVID-19, today we’ll focus on ways to try to keep customers paying.

But, before we do that, I have a favor to ask…

2020 Utility Staffing Survey

Unfortunately, the 2020 Utility Staffing Survey kicked off just before the COVID-19 crisis hit us full force and participation at this point in the survey isn’t what I’d hoped for. Several subscribers responded to the appeal in the last issue and, as of today, this year’s survey is on pace with the 2018 Utility Staffing Survey, but still a good bit behind the participation level from the 2019 Utility Fee Survey.

If you haven’t yet participated and have five minutes to spare, please click here to complete the survey. If you’ve already completed the survey, thank you!

This will be the last time I plead with you to participate because the next blog post will publish the first of two results issues.

Thank you in advance for taking the time to complete the survey!

Now, back to the fun stuff!

Uncertain times

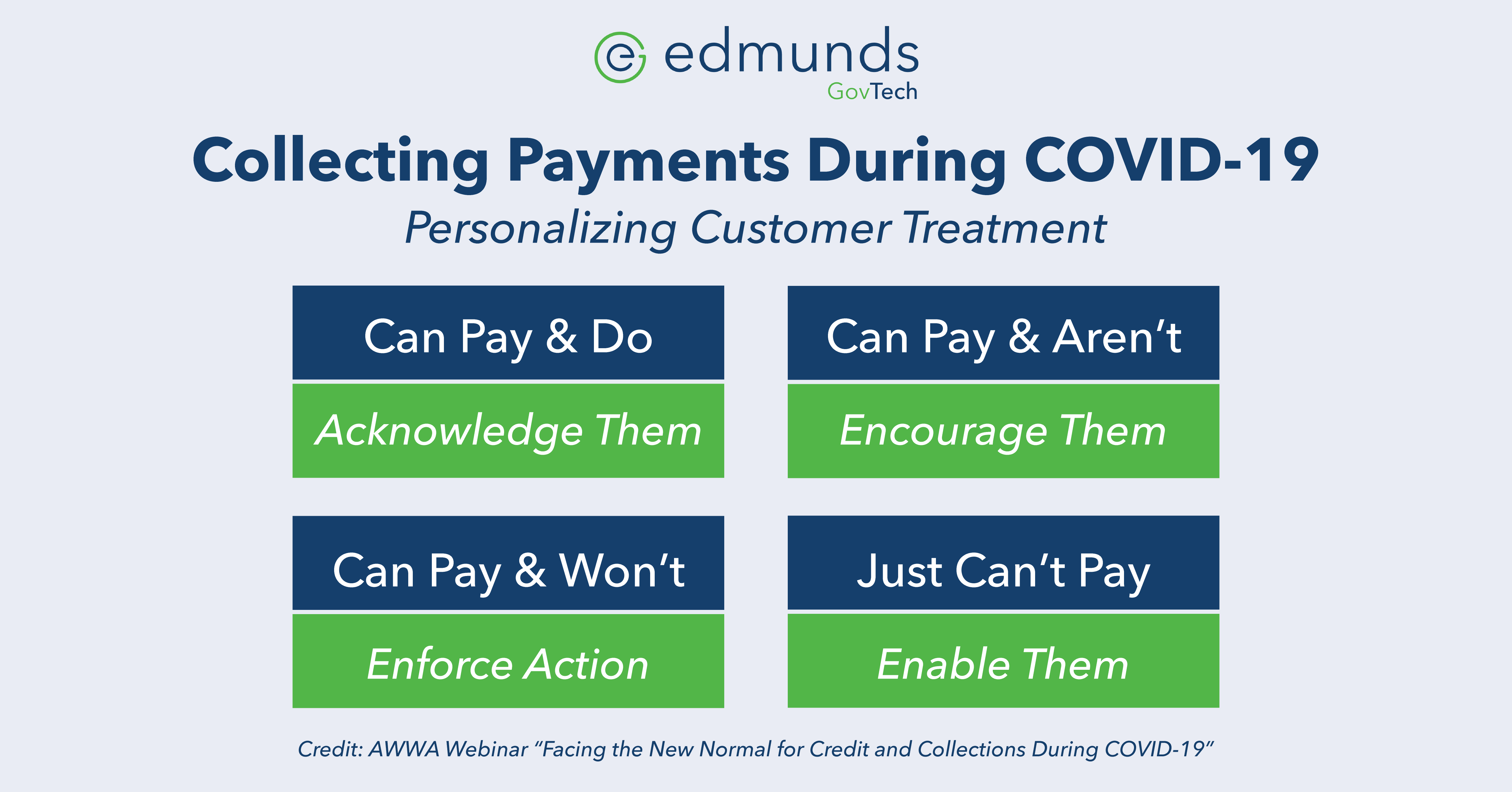

We all understand that we’re living in very uncertain times. Many people are out of work and may be unable to pay their bills. Others, knowing that your utility won’t disconnect them for non-payment, may choose not to. So, what are the best approaches to dealing with customers in very different circumstances?

I had been trying to formulate this blog post when I participated in a webinar last week sponsored by the AWWA titled “Facing the New Normal for Credit and Collections During COVID-19”. That webinar included a graphic grouping customers into four categories which helped me focus my ideas, the essence of which is reproduced below:

Before we look at strategies for encouraging and enabling customers on the right side of the graphic, it would be an oversight not to mention those who fall into the upper-left corner – your best customers.

Even if it’s nothing more than a simple “thank you” when you’re on the phone with customers, be sure to acknowledge those who are continuing to pay on time.

So, what can you do to entice or encourage your customers to pay?

Automatic payments

I’ve you’ve ever heard me speak at a conference or trade show, you know I’m adamant about bank drafts being the easiest way to collect payments. That holds true now more than ever. Customers who are signed up for automatic payments, whether it’s by bank draft or recurring credit card, will continue to have their payment processed unless they take steps to stop those payments.

With many utility offices closed to the public, and no way for your customers to pay in person, when they call your office asking how they can pay, why not offer to sign them up for bank drafts?

Suspend convenience fees

During the COVID-19 pandemic, some utilities have suspended convenience fees to entice more customers to pay online. Absorbing the credit card fees will increase your expenses, but it if encourages more customers to pay, the increased cash flow may be worth the additional expense.

Round-up and contribution plans

A customer reached out last week asking if Logics’ billing software supports round-up programs to fund a customer assistance program. Having a customer assistance plan in place is one way to enable those customers in the lower-right quadrant of the graphic.

When I responded that our software does indeed support round-up programs, I also offered one piece of advice I would offer any utility collecting funds for customer assistance programs. That advice is to find a charity or social services agency in your area to administer the program. Organizations such as these are in the business of evaluating needs and making difficult decisions about allocating limited funds. Delegating this responsibility to another agency insulates your utility from claims of favoritism and unfair practices.

Another way to fund customer assistance programs is voluntary contributions. These can take the form of an opt-in charge on the customer’s utility bill or encouraging customers to make an additional payment over and above the amount of their bill.

And be sure to say “thank you” to your customers who contribute to your customer assistance program!

Messaging to your customers

Even if you don’t normally send delinquent notices, now might be the right time to do so. Using softened, non-threatening language you can use what would normally be a more demanding late notice to persuade customers to pay what they can.

Use these notices to not only encourage customers to pay, but also to let them know how much they owe and what repayment options are available to them.

If you mail full-page bills in an envelope, consider including an insert informing your customers of what your COVID-19 policies are, including when you will resume assessing late fees and disconnecting for non-payment. Bill inserts are also a good way to publicize your customer assistance and round-up programs.

And, of course, be sure to include all of this information on your website, as well!

Applying deposits

I have heard of some utilities contemplating applying security deposits for customers who are unable to pay. While this creates a short-term influx of cash for your utility, and a corresponding reduction in delinquent balances, it creates a longer-term problem. Namely, you must get them to repay the deposit once things return to normal or those customers without deposits become a greater risk for write-offs.

EFC poll

If you work for a water or wastewater utility based in North Carolina, the Environmental Finance Center at UNC wants to hear from you. They have created a six-question poll asking how COVID-19 has affected your utility. The poll closes at 5:00 pm today, so if you haven’t already participated, you can do so here – http://go.unc.edu/covidpoll0429.