Following up on the last post about how utilities are dealing with the COVID-19 virus, this issue will examine the financial impact of the pandemic.

As you might imagine, it is not a pretty picture.

Suspending late fees and disconnects

Many utilities took the early step of suspending disconnects for non-payment and some went as far as to also stop assessing late fees. (If you are located in North Carolina, you are now mandated by Gov. Cooper’s Executive Order 124 to suspend late fees and disconnection for non-payment for residential accounts for 60 days.) I contacted several utilities last week to see if they had seen any early indications of how this might impact them.

As you might expect, I heard from several that it was too early to tell. However, I did hear from three utilities who are already feeling the effect. Below is a synopsis of those responses, in order of how severe the early repercussions are.

The least severe of the three, with 25,000 accounts and four monthly billing cycles, stated “We have suspended disconnects for non-payment, but not the late fees. Before all the madness our typical cut-off/late payments percentage was around 20%. The actual disconnected accounts would be more like 15%. Since suspending our disconnects, the percentage of accounts that are past due has risen to 25%.”

The second utility, with 4,700 accounts and two monthly billing cycles, reported normal cut-offs of 150 to 200 accounts. They ran a trial run of the cut-off process and the number of accounts to be disconnected was over 500.

Finally, the third utility, with about 10,000 accounts and three monthly billing cycles, relayed “The data we have right now shows an increase of 300% in what would have been disconnected. We still have one zone that would not be factored in this data. Likely that will increase because that zone has the most economically challenged customers by percentage.”

So, there you have it – increases in delinquent accounts of 25%, 150%, and 300%. None of it is pretty, but the worse cases are downright ugly!

Impact of stay-at-home orders

With many areas of the country under stay-at-home orders with large numbers of businesses either closed, operating at less than capacity, or most staff working from home, I wondered what effect this would have on usage patterns.

Many utilities have yet to bill for a full month, or even at all, since the stay-at-home orders went into place, so I reached out to several utilities with AMI systems. Many thanks to Lauren Brown of MeterSYS for her assistance in identifying utilities with AMI systems and capturing some of the data for me.

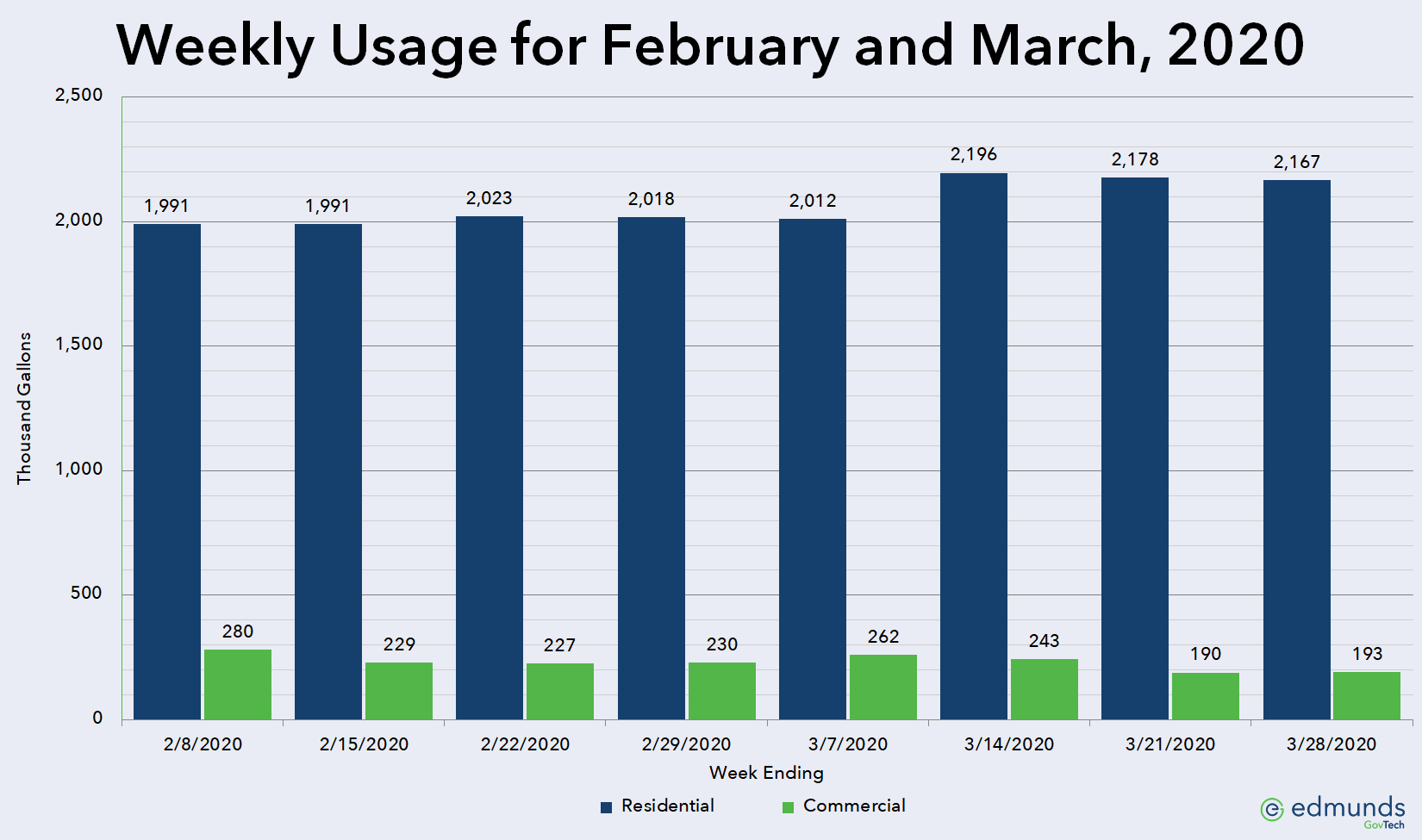

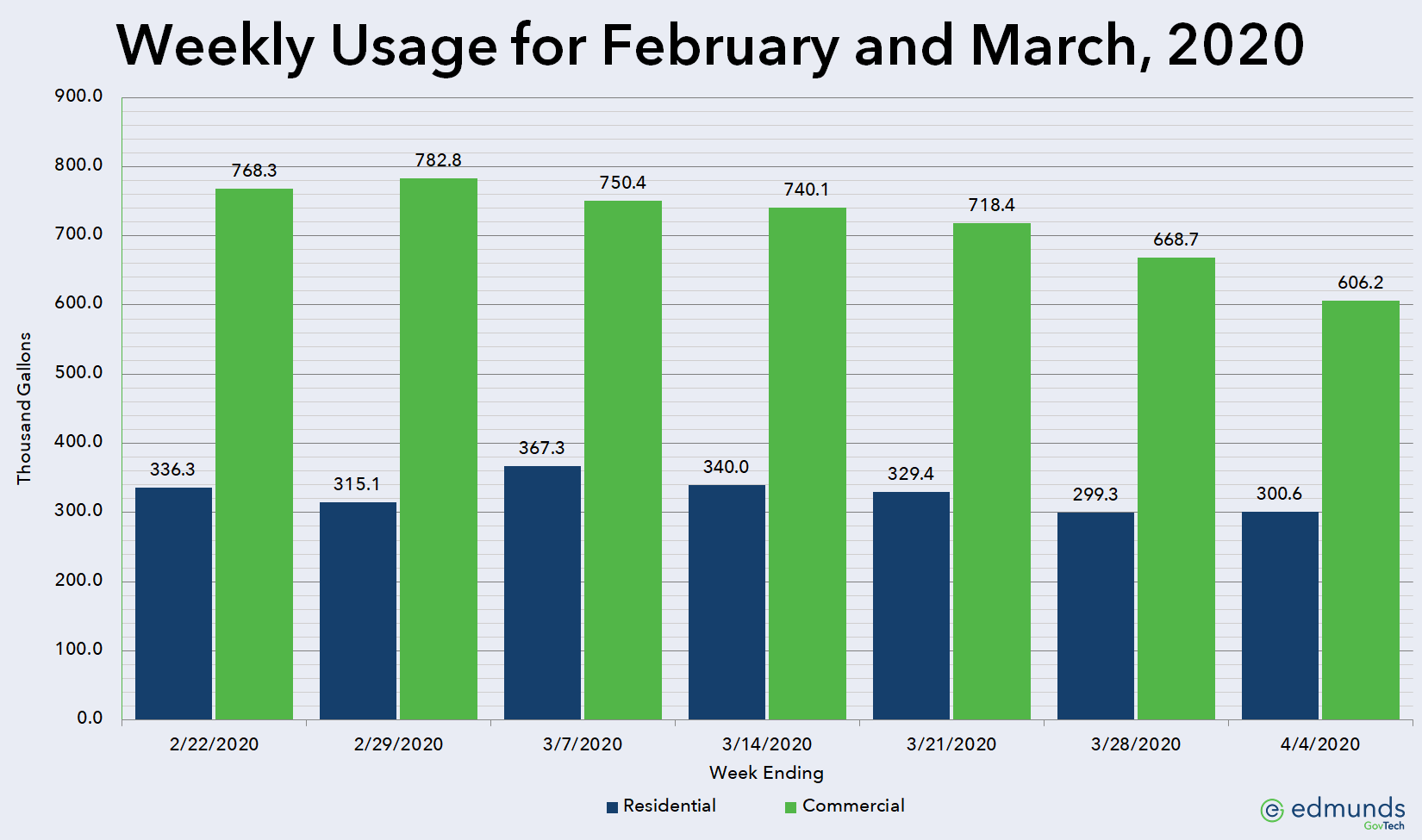

Below are weekly usage data for February and March for the Town of North East, Maryland, where stay-at-home orders only went in place last week (clicking on any of the graphs will open a larger image in a new window):

Residential usage remained relatively flat until the week of March 14, then decreased slightly for the two following weeks. Commercial usage has trended downward for the month of March with a slight uptick for the last week in March. Again, this data predates the issuance of a stay-at-home order, so I would anticipate these usage patterns will be much different for the month of April.

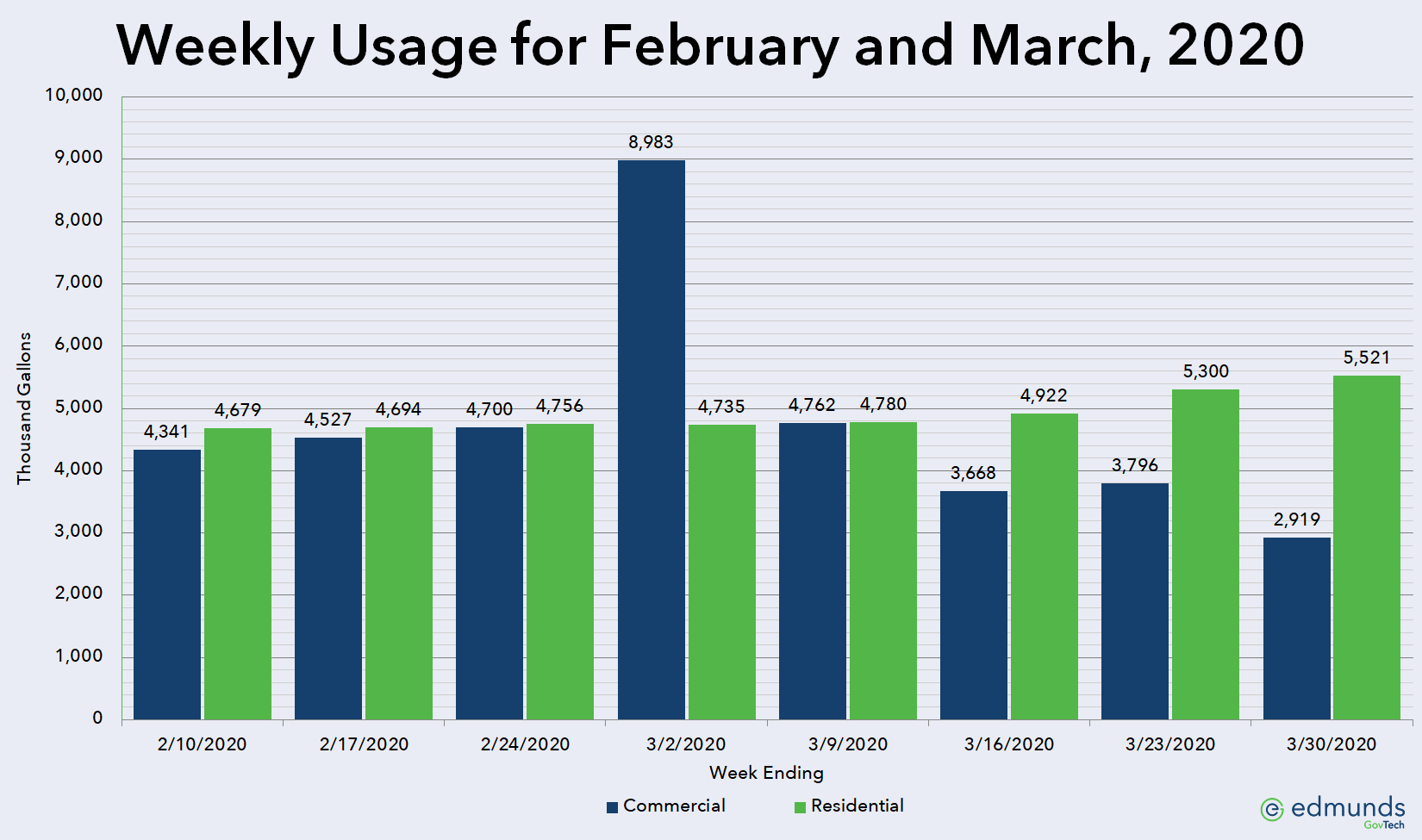

A second utility reported data more in line with what I suspected the trends would be. Below is the graph of their weekly usage for the months of February and March:

The commercial usage for the week of March 2 is an anomaly because the three consecutive days of February 25-27 were three of the four days with the most usage since January 1, 2019. I can only assume a commercial customer had a very bad leak during that time period.

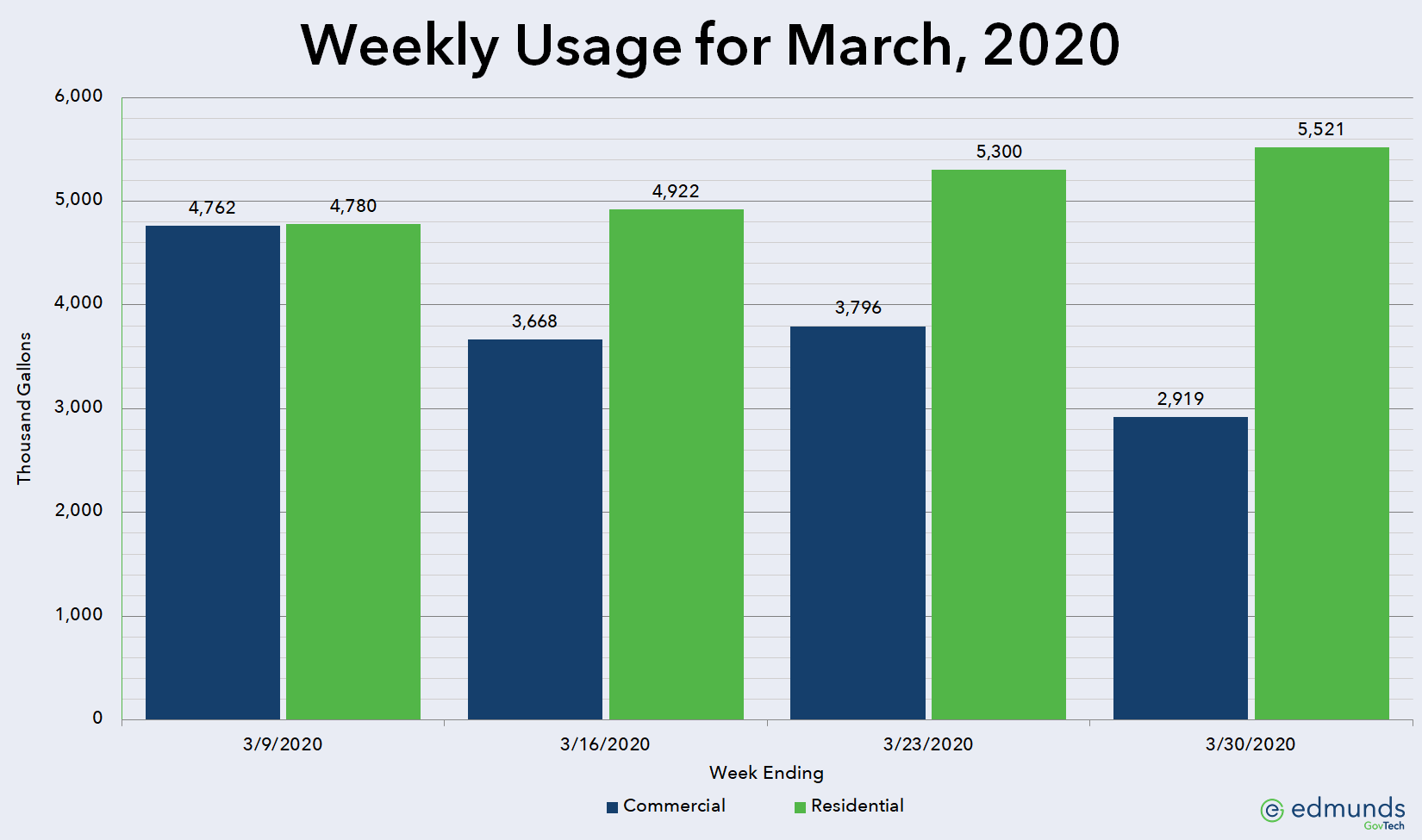

The month of March (which is illustrated in the attention-grabbing lead graphic at the top of the article) tells quite a dramatic story of increased residential usage coupled with decreased commercial consumption.

Finally, a third, smaller utility reported significant decreases in both residential and commercial usage for the month of March:

What your utility experiences will depend on the composition of your customer base and their unique usage habits, but I think it’s safe to assume commercial usage will drop, quite possibly significantly.

Impact on revenues and cash flow

Depending on your rate structure – do commercial accounts pay higher rates than residential accounts or do you have more steeply increasing block rates for commercial accounts? – this could have a significant impact on your revenues.

Even if your residential and commercial rates are the same, and increased residential usage offsets the reduction in commercial demand, I would still anticipate significantly reduced cash flow due to residential customers either being unable or unwilling to pay their utility bills.

Let’s be honest, with no late fees and disconnections for non-payment suspended, your customers have little incentive to pay other than a desire to do the right thing or wanting to stay current with their bills. If, based on the scenarios above, you see “just” a doubling of the number of customers who don’t pay, and those unpaid bills are larger due to residents staying at home and using more, your cash flow will be significantly impacted.

Establishing payment plans

What happens when the COVID-19 pandemic abates and you resume normal operations, including assessing late fees and disconnecting for non-payment? You will likely have a substantial number of customers with outstanding balances spanning several months. Is it fair to cut them off and demand full payment before reconnecting them?

You will likely find yourself having to establish payment plans with your customers (again, if you are in North Carolina, EO 124 mandates you allow customers to set up payment plans over a six-month period). Do you already have a payment plan policy in place? If not, now is the time to do so – before you become inundated with requests for payment plans.

If your billing software doesn’t offer a way to track payment plans, and you don’t want to keep up with them manually, why not set up your customers with installment services? This would involve adjusting the amount of the payment plan off from the customer’s balance, then adding it back over an agreed-upon number of billing periods. This way, if your customer misses a scheduled payment, they will appear on the cut-off list, the same as any other delinquent customer.

Is your payment plan policy up-to-date?

If you need assistance establishing or updating a payment plan policy, please contact me by completing this form to see how a business review could help you establish one and improve your overall office operation.

2020 Utility Staffing Survey

In the midst of all this craziness, I’m still conducting the 2020 Utility Staffing Survey. As you might imagine, participation is down from previous years. If you haven’t yet participated in the survey, please click here to complete the survey. This should take less than five minutes to complete. The results will be published in a series of upcoming blog posts.

I’d like as much participation as possible in the survey, so please feel free to forward this to your peers at other utilities.

Thank you in advance for taking the time to complete the survey and for sharing it with other utilities.