Last week, in one of the listservs I subscribe to, a question was posed about the percentage of accounts that are paid on time vs. late vs. actually cut-off.

Thinking about the question, I realized two previous issues, about cut-off policies and late fees, have dealt with the results of a Delinquent Accounts Study I conducted for our 2010 User Meeting.

But one topic from that study I haven’t written about is the percentage of accounts that were assessed a late penalty or cut off for non-payment.

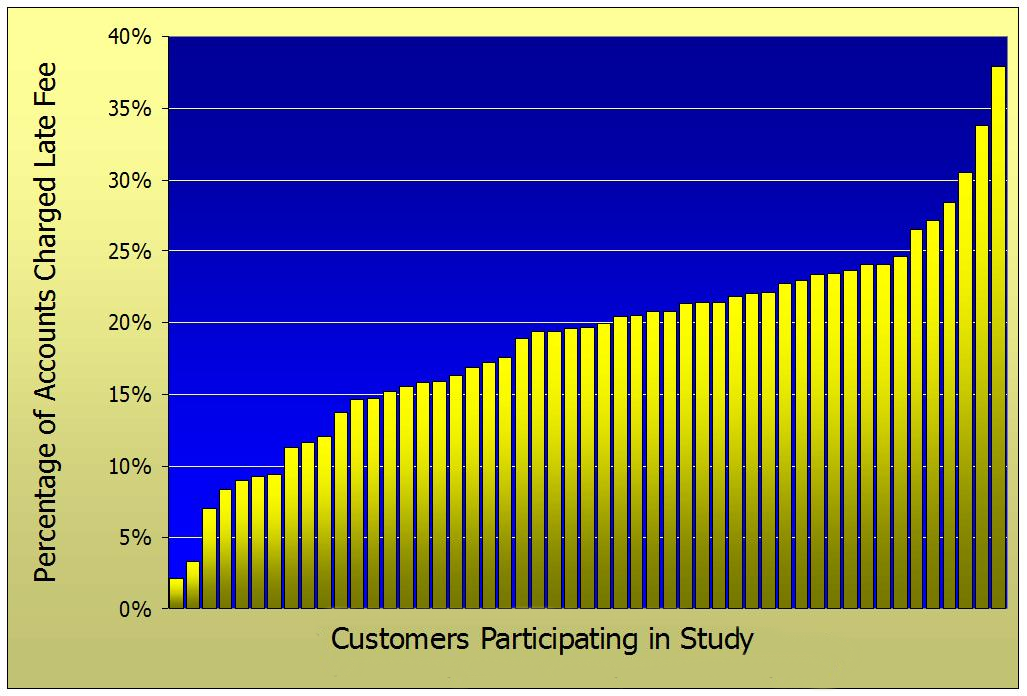

Percentage of accounts charged a late fee

Of the 51 study respondents whose data was analyzed, the percentage of accounts assessed a late fee ranged from 2.15% to 37.91%, as shown in the graph below:

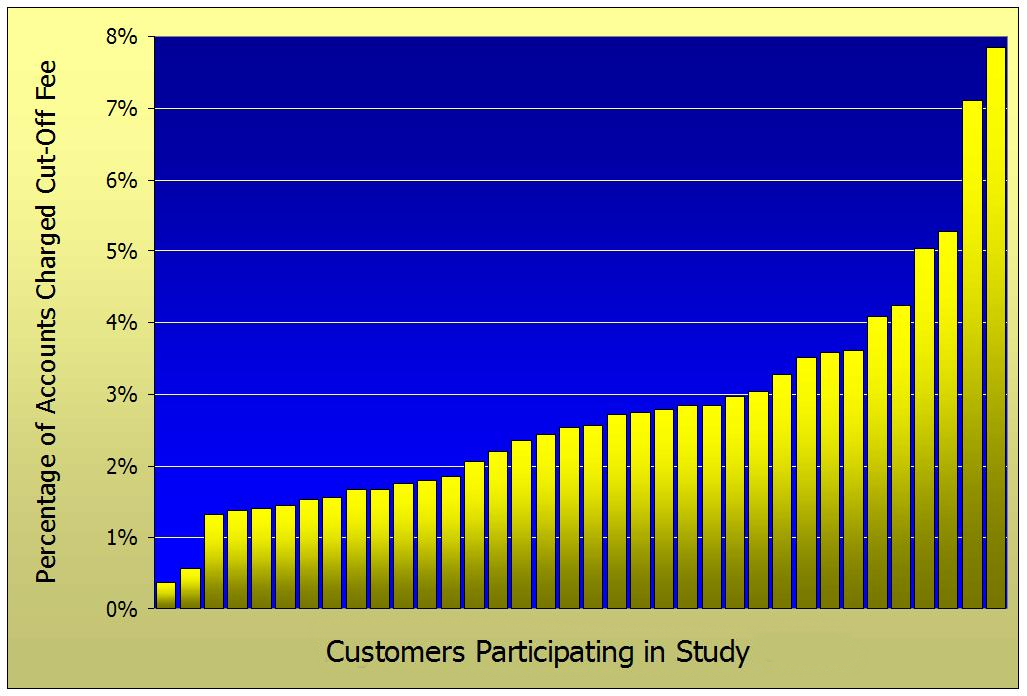

Percentage of accounts charged cut-off fee

Only 41 of the customers who participated in the study charge the cut-off fee to every account when the cut-off list leaves the office. Of those 41 customers, data from 36 was analyzed and the percentage of accounts charged a cut-off fee ranged from .37% to 7.85%, as depicted by this graph:

What are acceptable ranges?

Based on the results of the study and personal experience, below are the general rules of thumb that I follow for acceptable ranges of delinquent accounts:

Accounts assessed a late fee:

- < 15% – Excellent

- 15-25% – Normal range

- > 25% – Room for improvement

Accounts cut off for non-payment:

- < 2% – Excellent

- 2-3% – Normal range

- > 3% – Room for improvement

These percentages are influenced by a number of factors, including:

- “corporate culture” of the utility

- demographics of the customer base

- length of time to pay

- amount of the resulting fee

Use as a benchmark for self-improvement

The percentages above are general guidelines and can vary widely from utility to utility. If your percentages are higher than you would like them to be, don’t panic.

Rather than comparing your utility to other utilities, why not use your current percentage as a benchmark to improve upon?