Last week I gave my Improving Revenue Collections for Utilities presentation before a live audience for the first time since COVID-19 began. I’ve done several (and have two more scheduled) virtual presentations, including WaterPro 2020, the annual conference of the National Rural Water Association. You can view a recording of the WaterPro 2020 presentation here.

An “aha” moment

The biggest difference when presenting live, as compared to a virtual presentation, is feeling the energy in the room. It’s much easier, as a speaker, to tell if the audience is engaged when I can see people nodding their heads in agreement and sharing “I hadn’t thought about that” looks with others in the room.

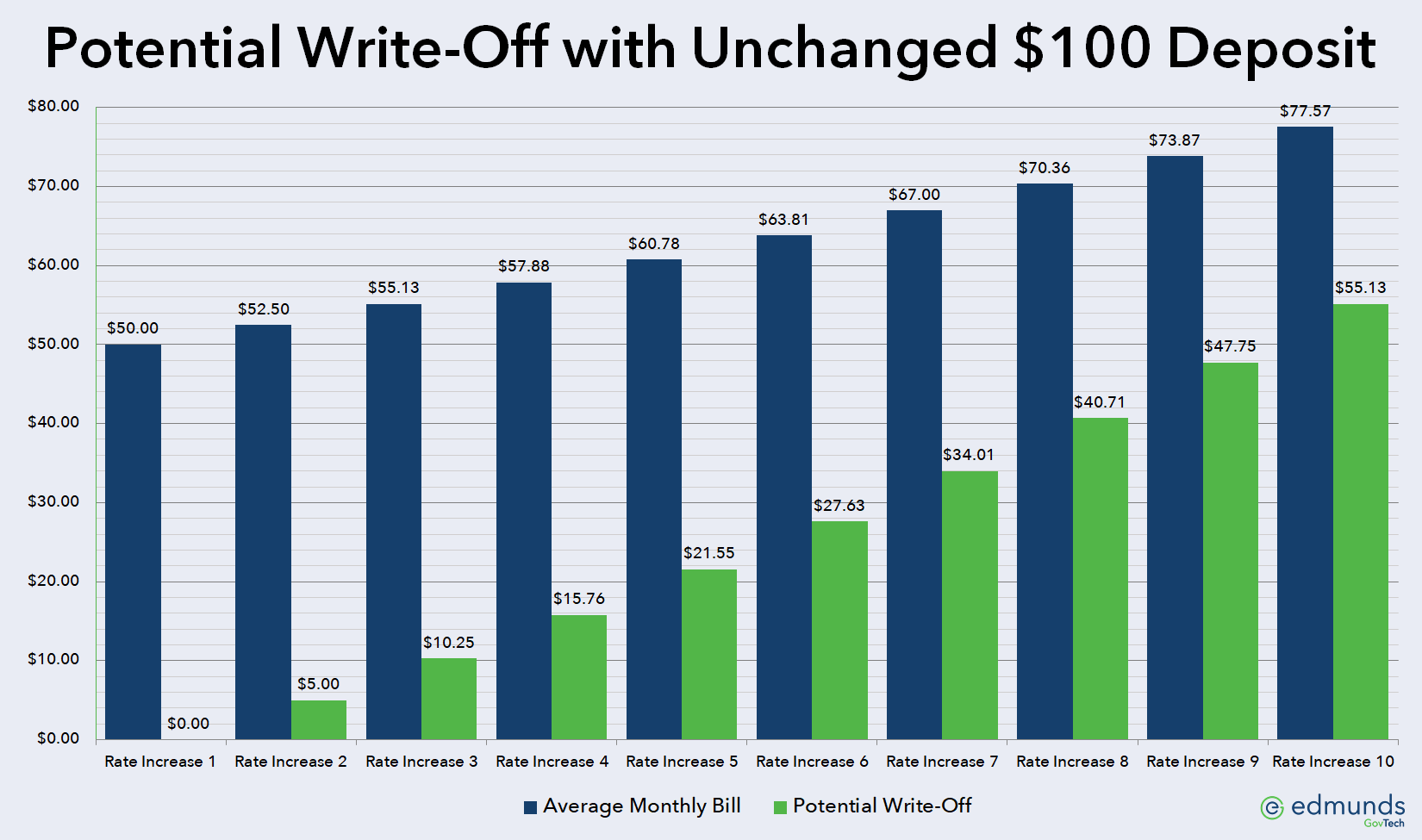

One such “aha” moment occurred during last week’s presentation as I was explaining why it is important to increase your security deposit each time you have a rate increase.

Maintaining an adequate security deposit

If you’ve been a reader of my blog for any length of time, or if you’ve heard me speak, you know how much of an impact your Days of Exposure has on determining an adequate security deposit. For this reason, I encourage utilities to increase their security deposit a corresponding amount with each rate increase.

Hypothetical example

Let’s look at an example of what happens if a hypothetical utility incurs ten consecutive rate increases without increasing their security deposit. In this example, the utility has an excellent 60 Days of Exposure and starts with an average residential bill of $50.00 and a $100.00 security deposit. The security deposit remains unchanged through a series of 5% rate increases. After the tenth rate increase, the utility’s potential write-off exposure has increased from nothing to $55.13 as illustrated below (clicking on the image will open a large graph in a new window):