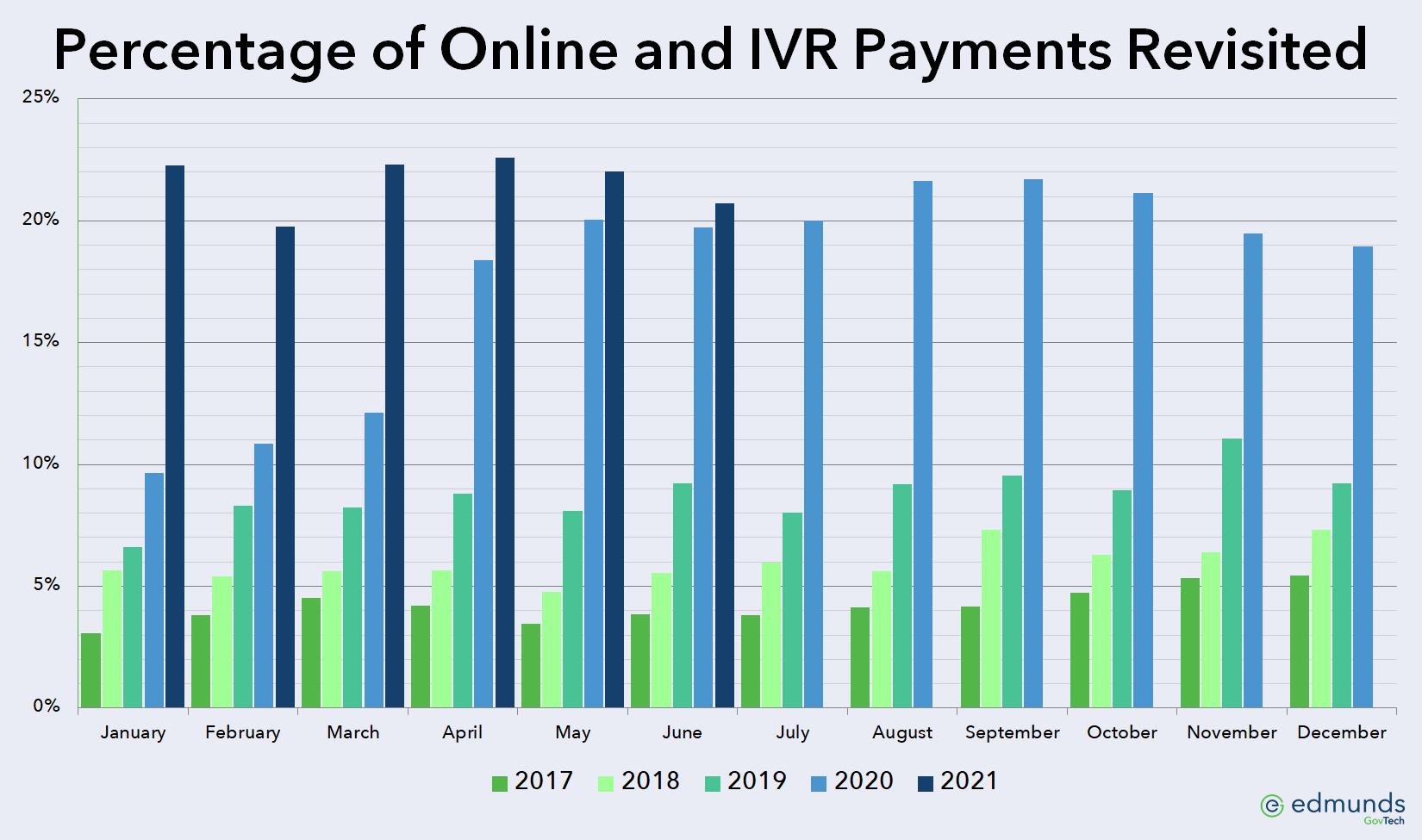

Eleven months ago, I wrote about the effect of suspending convenience fees due to COVID-19. That blog post focused on a utility that saw a dramatic increase in the number of customers paying online or over the phone using their IVR system after they suspended their convenience fee.

Updated data

I’ve used that graph in a number of presentations to utility conferences and wondered if it was time to update the graph. I also wondered if they had reinstated the convenience fee (hint, they haven’t – more about that below), and what effect that might have had.

So, I re-ran the queries and produced an up-to-date graph, shown here (clicking on the image will open a larger graph in a new window):

Sustained results

If you remember from the original post, this utility suspended their convenience fee in mid-March, just after the February due date had passed. Therefore, the impact of not charging a convenience fee wasn’t reflected until April.

As you can see from the graph, the percentage of customers paying online jumped by more than 50% from 12.11% in March, 2020 to 18.37% in April, 2020. Since then, it only dropped below 19% one time – to 18.95% in December. Interestingly, the drop in December wasn’t due to fewer online or IVR payments, but rather more payments overall – possibly due to more partial payments.

Incidentally, for the three months in 2021 that overlap with the increased volume in 2020, the percentage of customers paying online or by IVR has continued to increase, compared to the same month last year.

Doing away with convenience fees completely

Based on the response from their customer base, this utility has made the decision to not reinstate the convenience fee. In talking with their finance officer, he mentioned not only the reduced staff workload, but also the reduced number of returned checks with the increase in credit card payments.